Chapter 5 The Behavior of Interest Rates

1) If

the expected return on ABC stock rises from 5 to 10 percent and the expected

return on CBS stock is unchanged, then the expected return of holding CBS stock

_____ relative to ABC stock and the demand for CBS stock _____.

A)

rises; rises B) rises; falls

C) falls; rises D) falls; falls

Answer:

D

5) If

the expected return on CBS stock rises from 5 to 10 percent and the expected

return on NBC stock rises from 12 to 18 percent, then the expected return of

holding CBS stock _____ relative to NBC stock and the demand for CBS stock

_____.

A)

rises; rises B) rises; falls

C) falls; rises D) falls; falls

Answer:

D

10) If

wealth increases, the demand for stocks _____ and that of long-term bonds

_____.

A)

increases; increases B) increases; decreases

C)

decreases; decreases D) decreases; increases

Answer:

A

15) If

interest rates on Treasury bonds are suddenly expected to shoot up, then, other

things equal, the demand for houses will _____ and that of Treasury bonds will

_____.

A)

increase; increase B) increase; decrease

C)

decrease; decrease D) decrease; increase

Answer:

B

20) The demand

for silver bullion decreases, other things equal, when

A)

the gold market is suddenly expected to boom.

B)

the market for silver bullion becomes more liquid.

C)

wealth grows rapidly.

D)

any of the above occurs.

Answer:

A

25) You

would be less willing to purchase U.S. Treasury bonds, other things equal, if

A)

brokerage fees for trading stocks decline.

B)

you expect interest rates to rise.

C)

gold becomes more liquid.

D)

any of the above occurs.

E)

either (b) or (c) of the above occurs.

Answer:

D

30) Holding

everything else constant,

A)

if an asset's risk rises relative to that of alternative assets, the demand

will fall.

B)

the more liquid an asset, relative to alternative assets, the greater will be

the demand.

C)

the higher the expected return relative to alternative assets, the greater will

be the demand.

D)

all of the above.

E)

only (a) and (b) of the above.

Answer:

D

35) If the

price of real estate becomes less volatile, then, other things equal, the demand

for stocks will _____ and that of antiques will _____.

A)

increase; increase B) increase; decrease

C)

decrease; decrease D) decrease; increase

Answer:

C

40) You

would be less willing to purchase U.S. Treasury bonds, other things equal, if

A)

you expect interest rates to rise.

B)

gold becomes more liquid.

C)

you inherit $1 million from your Uncle Harry.

D)

any of the above occurs.

E)

either (a) or (b) of the above occurs.

Answer:

E

45) When the price of a bond is below the equilibrium

price, there is an excess _____ for (of) bonds and price will _____.

A)

demand; rise B) demand; fall

C) supply; fall D) supply; rise

Answer:

A

50) When the interest rate on a bond is below the

equilibrium interest rate, in the bond market there is excess _____ and the

interest rate will _____.

A)

demand; rise B) demand; fall

C) supply; fall D) supply; rise

Answer:

D

55) When

the interest rate rises, either the demand for bonds ______ or the supply of

bonds

_____.

A)

increases; increases B) increases; decreases

C)

decreases; decreases D) decreases; increases

Answer:

D

60) When stock prices become less volatile, the

______ curve for bonds shifts to the _____.

A)

demand; right B) demand; left

C) supply; left D) supply; right

Answer:

B

65) If people expect real estate prices to decrease

significantly, the _____ curve for bonds will shift to the _____.

A)

demand; right B) demand; left

C) supply; left D) supply; right

Answer:

A

70) When bond interest rates become more volatile,

the demand for bonds _____ and the interest rate _____.

A)

increases; rises B) increases;

falls C) decreases; falls D) decreases; rises

Answer:

D

75) When people begin to expect a run up in large

stock market, the demand curve for bonds shifts to the _____ and the interest

rate _____.

A)

right; rises B) right; falls

C) left; falls D) left; rises

Answer:

D

80) When prices in the stock market become more uncertain,

the demand curve for bonds shifts to the _____ and the interest rate _____.

A)

right; rises B) right; falls

C) left; falls D) left; rises

Answer:

B

85) When real income increases, the demand curve

for money shifts to the _____ and the interest rate _____.

A)

right; rises B) right; fall

C) left; falls D) left; rises

Answer:

A

90) When the price level _____, the demand curve

for money shifts to the _____ and the interest rate _____.

A)

falls; left; falls

B)

falls; right; falls

C)

falls; left; rises

D)

rises; right; rises

E)

rises; right; falls

Answer:

D

95) When the Fed increases the money stock, the

money supply curve shifts to the _____ and the interest rate _____.

A)

right; rises B) right; falls

C) left; falls D) left; rises

Answer:

B

100) When stock prices become _____ volatile,

the demand curve for bonds shifts to the _____ and the interest rate _____.

A)

more; right; rises

B)

more; left; falls

C)

less; left; falls

D)

less; left; rises

E)

more; right; falls

Answer:

E

105) When

the growth rate of the money supply is decreased, interest rates will fall

immediately

if

the liquidity effect is _____ than the other money supply effects and there is

_____

adjustment

of expected inflation.

A) larger;

fast B) larger; slow C) smaller; slow D) smaller; fast

Answer: D

110) If

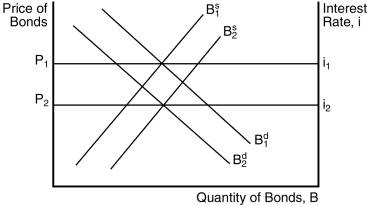

the Fed wants to permanently lower interest rates, then it should raise the

rate of money growth if

A)

there is fast adjustment of expected inflation.

B) there is slow adjustment of

expected inflation.

C) the liquidity effect is smaller

than the expected inflation effect.

D) the liquidity effect is larger

than the other effects.

Answer: D

115) The

theory of asset demand provides a framework for deciding what factors cause the

demand curve for bonds shift.

These factors include changes in the

A)

wealth of investors.

B)

liquidity of bonds relative to alternative assets.

C)

expected returns on bonds relative to alternative assets.

D)

risk of bonds relative to alternative assets.

E)

all of the above.

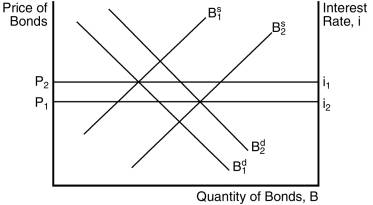

Answer:

E

120) Holding

the expected return on bonds constant, an increase in the expected return on

common stocks would _____ the demand for bonds, shifting the demand curve to

the _____.

A)

decrease; left B) decrease; right

C) increase; left D) increase; right

Answer:

A

125) A

decrease in the expected rate of inflation will _____ the expected return on

bonds relative to the that on _____ assets, and shift the _____ curve to the

left.

A)

reduce; financial; demand

B)

reduce; real; demand

C)

raise; financial; supply

D)

raise; real; supply

E)

raise; real; demand

Answer:

E

130) All

else the same, an increase in the volatility of the stock market causes the demand

for bonds to _____ and the demand curve to shift to the _____.

A)

fall; right B) fall, left C) rise; right D) rise; left

Answer:

C

135) Factors that cause the demand curve

for bonds to shift to the right include

A)

a decrease in the inflation rate.

B) an increase in the volatility of

stock prices.

C) an increase in the liquidity of

stocks.

D) all of the above.

E) only (a) and (b) of the above.

Answer: E

140) Factors

that cause the demand curve for bonds to shift to the left include

A) an increase in the volatility of

stock prices.

B) a decrease in the expected

returns on stocks.

C) a decrease in the inflation

rate.

D) a decrease in the riskiness of

stocks.

Answer: D

145) Factors that can cause the supply curve

for bonds to shift to the right include

A)

an expansion in overall economic activity.

B)

an increase in expected inflation.

C)

an increase in government deficits.

D)

all of the above.

E)

only (a) and (b) of the above.

Answer:

D

150) Factors that can cause the supply

curve for bonds to shift to the left include

A)

an expansion in overall economic activity.

B)

an increase in expected inflation.

C)

a decrease in government deficits.

D)

all of the above.

E)

only (a) and (b) of the above.

Answer:

C

155) The loanable funds framework is

easier to use when analyzing the effects of changes in _____, while the

liquidity preference framework provides a simpler analysis of the effects from

changes in income, the price level, and the supply of _____.

A)

expected inflation; bonds B) expected inflation; money

C)

government budget deficits, bonds D) government budget deficits, money

Answer:

B

160) A lower level of income causes the demand

for money to _____ and the demand curve for money to shift to the _____.

A)

decrease; right B) decrease; left

C) increase; right D) increase; left

Answer:

B

165) A higher level of income causes the

demand for money to _____ and the interest rate to _____.

A)

decrease; decrease B) decrease; increase

C)

increase; decrease D) increase; increase

Answer:

D

170) Holding everything else equal, an

increase in the money supply causes

A)

interest rates to decline initially.

B)

interest rates to increase initially.

C)

bond prices to increase initially.

D)

both (a) and (c) of the above.

E)

both (b) and (c) of the above.

Answer:

D

175) Of the four effects on interest

rates from an increase in the money supply, the one that works in the opposite

direction of the other three is the

A)

liquidity effect. B) income effect.

C)

price level effect. D) expected inflation effect.

Answer:

A

180) The supply curve for bonds has the usual

upward slope, indicating that as the price _____, ceteris paribus, the _____

increases.

A)

falls, supply B) falls, quantity supplied

C)

rises, supply D) rises, quantity supplied

Answer:

D

185) In a contracting economy with

declining wealth, the demand for bonds _____ and the demand curve for bonds

shifts to the _____.

A)

rises, right B) rises, left

C) falls, right D) falls, left

Answer:

D

190) An increase in the liquidity of

bonds results in a _____ in demand for bonds and the demand curve shifts to the

_____.

A)

rise, right B) rise, left C) fall, right D) fall, left

Answer:

A

195) Higher government deficits _____

the supply of bonds and shift the supply curve to the _____.

A)

increase, left B) increase, right

C) decrease, left D) decrease, right

Answer:

B

200) When the inflation rate is expected

to increase, the _____ for bonds falls, while the _____ curve shifts to the

right.

A)

demand, demand B) demand, supply

C)

supply, demand D) supply, supply

Answer:

B

205) During a business cycle

contraction, the supply of bonds shifts to the _____ as businesses perceive

fewer profitable investment opportunities, while the demand for bonds shifts to

the _____ as a result of the decrease in wealth.

A)

right, left B) right, right

C) left, left D) left, right

Answer:

C

210) In the Keynesian liquidity

preference framework, a lower level of income causes the demand for money to

_____ and the demand curve to shift to the _____.

A)

increase, left B) increase, right

C) decrease, left D) decrease, right

Answer:

C

215) If the liquidity effect is smaller

than the other effects, and the adjustment to expected inflation is slow, then

the

A)

interest rate will fall.

B)

interest rate will rise.

C)

interest rate will initially fall but eventually climb above the initial level

in response to an increase in money growth.

D)

interest rate will initially rise but eventually fall below the initial level

in response to an increase in money growth.

Answer:

C

Figure 5-1

220) In Figure 5-1, an increase in the

expected inflation rate causes the

A)

interest rate to increase from i1 to i2.

B)

interest rate to decrease from i2 to i1.

C)

demand curve for bonds to shift to the left.

D)

both (a) and (c) of the above.

E)

both (b) and (c) of the above.

Answer:

D

225) In Figure 5-1, one factor that

would not have caused the demand for bonds to decrease (shift to the left) is

A)

a decrease in the expected return on bonds relative to other assets.

B)

an increase in wealth.

C)

a decrease in wealth.

D)

an increase in the riskiness of bonds relative to other assets.

Answer:

B

230) In Figure 5-1, factors that could

cause the supply of bonds to shift to the right include:

A)

a decrease in government budget deficits.

B)

an increase in expected inflation.

C)

a recession.

D)

expectations of fewer profitable investment opportunities.

Answer:

B

235) In Figure 5-1, factors that could

cause the demand for bonds to decrease (shift to the left) include:

A)

an increase in the riskiness of bonds relative to other assets.

B)

a decrease in the expected rate of inflation.

C)

expectations of higher interest rates in the future.

D)

all of the above.

E)

only (a) and (b) of the above.

Answer:

D

240) In Figure 5-1, the increase in the

interest rate from i1 to i2 due to an increase in the

expected inflation rate is called the

A)

Fisher effect. B) liquidity

effect. C) income effect. D) Keynes effect.

Answer:

A

Figure 5-2

245) In Figure 5-2, one factor that would

not have caused the supply of bonds to increase is

A)

an increase in government budget deficits.

B)

a decrease in expected inflation.

C)

expectations of more profitable investment opportunities.

D)

a business cycle expansion.

Answer:

B

250) In Figure 5-2, factors that could

cause the demand for bonds to increase include:

A)

an increase in the riskiness of bonds relative to other assets.

B)

a decrease in the expected return on bonds relative to other assets.

C)

an increase in wealth.

D)

all of the above.

E)

only (a) and (b) of the above.

Answer:

C

Figure 5-3

255) In Figure 5-3, one factor not

responsible for the decline in the interest rate is

A)

a decline the price level.

B)

a decline in income.

C)

an increase in income.

D)

a decline in the expected inflation rate.

Answer:

C

260) In Figure 5-3, the decline in the

interest rate from i1 to i2 can be explained by

A)

a decrease in income.

B)

a decrease in the expected price level.

C)

an increase in money growth.

D)

both (a) and (b) of the above.

E)

both (a) and (c) of the above.

Answer:

D

Figure 5-5

265) Figure 5-5 illustrates the effect

of an increased rate of money supply growth. From the figure, one can conclude that the

A)

the Fisher effect is dominated by the liquidity effect and interest rates

adjust slowly to changes in expected inflation.

B)

the liquidity effect is dominated by the Fisher effect and interest rates

adjust slowly to changes in expected inflation.

C)

the liquidity effect is dominated by the Fisher effect and interest rates adjust quickly to

changes in expected inflation.

D)

the Fisher effect is smaller than the expected inflation effect and interest

rates adjust quickly to changes in expected inflation.

Answer:

C